MURDER, POLITICS, AND THE END OF THE JAZZ AGE

by Michael Wolraich

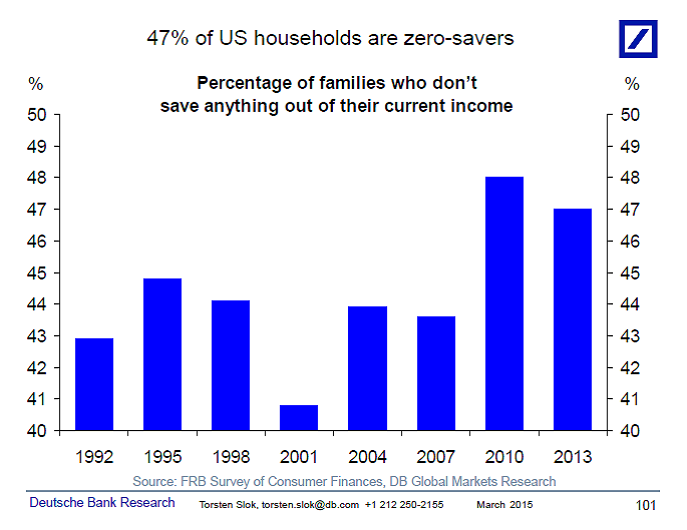

You heard, during the last campaign, that 47% of Americans "don't pay taxes," by which we mean Federal Income taxes (they pay many others at all levels of government). It has somehow been difficult to convince people that 47% of the population does not actually make enough money that they can be taxed in any meaningful way but at a median income of $50,000 a year and long-term, inflation-adjusted wage stagnation, I've always suspected it's true. From The Big Picture, some further evidence:

The percentage of Americans who do not pay federal income tax was not always so high. This happened when incomes dropped during and after the Financial Crisis. Well, look... the percentage of households with zero or negative savings rates was not always so high, either. This suggests to me that people would save, if they had the money.

The percentage of Americans who do not pay federal income tax was not always so high. This happened when incomes dropped during and after the Financial Crisis. Well, look... the percentage of households with zero or negative savings rates was not always so high, either. This suggests to me that people would save, if they had the money.

To be fair, I don't know that the non-savers and the non-taxpayers overlap 100%. I can imagine that a great fortune in its waning years might have a negative savings rate and a positive tax rate, for example. But I think, for the most part, that we now have dual evidence that most people do not have enough money. They make so little that they have no Federal income tax burden and they also make so little that not paying Federal income taxes does not create a surplus in their household budgets.

This is bad.

Comments

It used to pay to save, when interest rates were high. Now, if we have anything left over, there's no point in putting it into an account. Stuffing it in a sock pays just as well. Home equity used to be our ace-in-the-hole. No longer. Wages are stagnant and second jobs pay next to nothing.

Home prices, transportation costs, health care costs, education costs, grocery prices, clothing prices, utilities. . .everything has gone up while wages haven't. I'm surprised it's only 47%

by Ramona on Wed, 04/08/2015 - 3:48pm

Hell I made 4 cents last year on savings and checking.

And I think I was only charged 40 bucks. hahahahash

So far this year I made two cents and have had no bank charges.

by Richard Day on Wed, 04/08/2015 - 4:02pm

One out of 30 kids are homeless. One out 4 kids are food insecure, 51% of the children in this country lives below the poverty line.

I save every month both in a savings account and a sock. It is pretty modest so it really don't count in the real world but it does get used when needed. I have been into the sock a lot buying printer ink and school project supplies. Egyptian tomb is due Friday morning. Barbie is now a mummy.

I don't expect anything to change until after 2016.

by trkingmomoe on Wed, 04/08/2015 - 8:00pm

The 47%, check their W-2's:

- Pay Social Security tax

- Medicare tax

- Both of which go into general revenue and are immediately spent, with US Treasury Bonds for the excess funds over SS expenditures sent to the Social Security Trust Fund.

- and.........Republicans claim the Social Security Trust Fund doesn't exist

so explain to me how the 47% aren't paying taxes?

Usually at higher rates just w/SS/Medicare (15%) than hedge fund billionaires, who may pay no income tax or SS tax at all, just 'capital gains' tax (15% max before 'losses' 'expenses', deductions, evasion and chicanery).

by NCD on Thu, 04/09/2015 - 12:15am

There are bills being proposed, passed and signed into law in several states to put severe restrictions on welfare and SNAP recipients. Kansas, Missouri and Oregon are just three examples of legislatures that are convinced that low-income families are squandering their benefits.

Kansas Republicans think people on their temporary (36 month lifetime limit) assistance program must be deterred from spending funds on pools, spas, casinos and cruises, etc. - and may only withdraw $25.00 per day at ATMs. Missouri and Oregon plan to deny SNAP fund use for seafood, steak, cookies and other "wasteful" items.

Apparently dignity and an iota of self-determination are just too expensive nowadays.

by barefooted on Wed, 04/08/2015 - 9:09pm

Many of the 47% are plagued by fines, interest charges, and overdraft fees. The problem with living from paycheck to paycheck is that one or two bad events create a chain reaction that leads to car problems, loans, missed work, relatives needing assistance, on and on. The idea that these afflictions are confined to minorities is absurd---these problems are widespread among the white population.

But, Michael, I thought you would love this one. Wapo article today talks about the IRS in Dallas region being understaffed. If you owe 900,000 in back taxes, no problem, they are too busy to bother with anyone owing less than a million. The managing agent said it is especially hard to collect because normally they can garnish wages but "the millionaires" typically don't have paychecks.

I expect the small fry who owe back taxes mostly have their paychecks garnished.

by Oxy Mora on Thu, 04/09/2015 - 7:15pm

This is a great point. What will generally happen to somebody the IRS deems deficient of paying a smaller amount of taxes is this -- they will receive a notice, freak out and pay it or, if they can't, will call to make payment arrangements (at a time where the IRS is not even answering a majority of its calls) or they will ignore it. They likely will not have a private accountant to call and will find that the "audit defense" offered by discount accountants is kind of useless because this isn't an audit -- it starts as an IRS notice of deficiency which, if not sufficiently answered, is simply recorded as a revised tax filing, at which point it becomes a liability.

What happens next? If it isn't paid, the IRS can just wait and if you have a refund due next year, confiscate it to cover the balance plus interest and penalties. With that method, your wages never have to be garnished. You're basically paying the IRS forward at a higher rate. It can also grab your state refund or any special rebates like we had under W. Bush.

When it comes to lower taxes owed, the IRS can make itself whole through its own processes fairly easily and, the lower the amount owed, the more nonsensical it is for the taxpayer to higher accountants and lawyers to fight, even if the IRS is wrong.

The rich fight back. The IRS just rolls everyone else.

by Michael Maiello on Thu, 04/09/2015 - 9:38pm

Of course that is also why SS Medicare taxes are taken out up front on all workers paychecks.

by NCD on Fri, 04/10/2015 - 12:10am