MURDER, POLITICS, AND THE END OF THE JAZZ AGE

by Michael Wolraich

How do you alleviate economic inequality in America? It's easy to complain about greed and extravagance but much more difficult to come up with practical policies that would make a real difference in the long run.

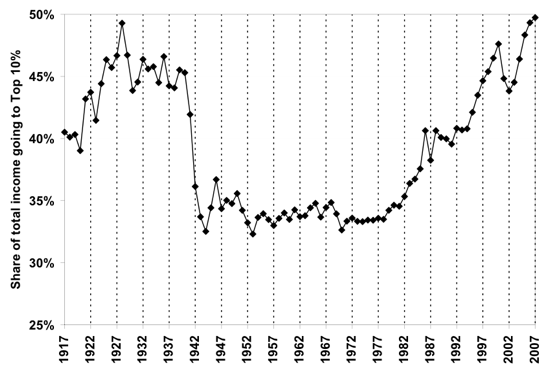

The default proposal these days is to increase tax rates on top income brackets, starting with an elimination of the Bush tax cuts. That may help a bit, but as you can see from the following graph, the trend toward income concentration did not begin with Bush's presidency, and it would take radical tax increases to get back to 1970s levels. The government would have to strip an additional 30 percent from the incomes of the top ten percent and somehow put that money into everyone else's pockets.

The Top Decile Income Share in the United States, 1917-2007

Leaving aside the unpopularity of such a large tax increase and its economic ramifications, is that even how we really want things work? My ideal progressive society is not one in which the rich bankroll the poor through taxation. It is one in which the differences between rich and poor are far less extreme than they are today.

The real trouble with income tax as a solution to economic inequality is that it addresses the symptom, not the disease. The fundamental problem of economic inequality is not the rich pay too few taxes relative to the rest of us; it's that they earn too much money relative to the rest of us.

So how can we address the disease itself? One solution is to prop up the bottom by raising the minimum wage. To my mind, that's a no-brainer, and I would like to see progressives take up the cause more vigorously, but it only addresses half the problem. If we increased the minimum wage at the same rate that the incomes of the top ten percent have risen over the past forty years, we'd risk severe inflation and/or high unemployment.

To significantly reduce income inequality without such repercussions, we not only have to accelerate wage growth at the bottom; we also have to restrict income growth among at the top, and that is a much trickier feat to pull off.

Let's first distinguish between the two primary income streams of the top ten percent: capital gains and wages. Of these, Berkeley economist Emmanuel Saez blames wages for most of the recent income gains among the top ten percent. That is to say, the rich have been getting richer faster because companies have been aggressively raising the salaries of their top employees.

In that case, one solution could be a pay cap, which would compress income inequality between two federal mandates, a maximum and minimum wage. But leaving aside the unpopularity and legal implications, this approach suffers from a couple of drawbacks. First, economic competition is a valuable motivational tool, particularly at the very top. We don't really want to fill the ranks of CEOs, bankers, and lawyers with clock-punching dead weight. Second, the intense pressure to hire the best will invariably force companies to find alternative ways to compensate their top employees, legally or illegally.

What we really want is not to prohibit companies from overpaying their employees but to discourage them. How do you effectively deter a corporation from taking some action? You have to hit them where it counts: the balance sheet.

I'm about to present half-baked--make that quarter-baked--proposal that has absolutely no chance of becoming law in the foreseeable future. I offer it as a seed for brainstorming, to get us thinking about how we might do things differently.

I propose that we link corporate taxes to corporate salaries. The higher a company pays its employees over a certain threshold, the more it owes the government. This proposal would not necessarily increase overall corporate tax rates, but it would shift more of the burden to companies with highly compensated employees, like investment banks, hedge funds, and law firms, and it would discourage larger corporations from overpaying top executives.

What I'm advocating is essentially a payroll tax, but it's a different kind of payroll tax from the FICA contributions currently deducted from paychecks. It would not be tied to particular social programs, it would not be shared with employees or withheld from paychecks, it would not be capped, it would not be applied below a specified threshold, and it would be progressive rather than proportional.

Unlike pay caps, a progressive payroll tax would not eliminate economic competition at the top; it would just make it more costly to overcompensate employees. If done correctly so as to include all forms of compensation--bonuses, stock options, golden parachutes, and so on--it should add deflationary pressure to the relentless income growth of top-earners.

Such changes might seem semantic to some. After all, what does it matter whether wealthy wage-earners are taxed directly on their salaries or indirectly through their employers? There are a few differences. Wages count against a company's pre-tax earnings, reducing their tax burden; corporate taxes do not. Progressive payroll taxes would not penalize people for working two jobs or having other sources of income. And individuals cannot use personal deductions to offset payroll taxes.

But the primary contrast is psychological. The distinction between "my money" and "the company's money" can make all the difference in the world. It reduces the pain of seeing one's paycheck docked. It assuages the sense of unfairness in which the rich already feel that they pay more than their share. And it undercuts the conservative complaint that progressive taxes punish success.

The psychological difference between appropriating personal income and penalizing companies for overcompensation could make it possible to achieve popular support for progressive tax rates that are more heavily weighted towards the upper brackets. The greater the weight at the top, the larger the deterrent against extreme compensation packages. And that could finally reverse the decades-long trend towards income concentration.

There are plenty of details to work out, of course. For instance, we would need to prevent companies from avoiding taxes by paying portions of their employees' salaries through shell companies and similar evasions. It may also be politically difficult to pass such a plan, since a radical change to corporate taxes would receive aggressive pushback from companies with substantial influence in Washington. But sometimes it's worth exploring crazy quarter-baked ideas just to see where they lead.

| Attachment | Size |

|---|---|

| 58.64 KB | |

| 274.88 KB |

Comments

I think you are on the right track to be thinking about a carrot and stick approach to the corporations, and not the individuals, to get the corporations to stop paying astronomical sums to individuals. I've watched it happen starting with the corporate raider thing in the late 70's, early 80's. Then it was all that American biz had to become lean and mean and increase productivity to compete with the Japanese. This coincided with the average Joe being newly allowed to buy stock, and without having a broker (day trading was a huge frenzy) with the new computer trading systems. And pension funds getting into stocks and mutual funds being created (and everyone's grandma even getting into the financial action once available only to the wealthy or connected, by switching from savings accounts to the newly available Certificates of Deposit.)

What happened at was a bidding war for the CEO's who could deliver increase in stock value, however they did it. This was driven by the vast increase in the population of shareholders, to include the middle class. They and their mutual fund directors drove it. (Much as we like to joke about Mitt Romney's statement about corporations being people, I suspect this is what he meant.)

Over the years, because of the bidding wars for the CEO's who could deliver, the astronomical pay packages became standard for all CEO's, including the mediocre and the bad.

Reversing the process of how it happened is the key to changing it, I think.

You really can't solve it that easily by the taxation of the individuals or income caps. There are too many tax attorneys ready to find another way to give them the money. (They already invented things like stock options and golden parachutes to make up for salary differences.) You've got to incentivize it, to get shareholders to want and demand far more reasonable pay for the bosses. A punitive tax or other kind of strong disincentive on the corporations themselves if they overpay individuals is thinking along the right lines on this, mho.

This is really is all tied up with the "we're not making stuff" problem, I think. Because what happened when the middle class was brought into the stock market was that everyone started trading stock to make a profit on it when they sold it, that stock itself became the product, no one cared about owning stock long term for dividends any longer. That's when the financialization of the economy really ramped up. It wasn't smart to make stuff and make profit on making stuff, it was smart to increase the value of your stock and pay some guy a lotta money who knew how to do that.

by artappraiser on Fri, 12/02/2011 - 1:56pm

It's not just CEOs. It's also investment bankers, lawyers, management consultants, (some) doctors, various executives, and other highly paid professionals. I didn't get into the reasons why the pay has gone up, but I agree that it has to do with intensive competition.

Subtracting out the cases of CEOs colluding with executive boards, I think that in most cases, the high salaries make sense from the point of view of the employers. If a slightly better i-banker can net your company an extra few million, then the $500K bonus he negotiated is well worth the cost.

The trouble is that it doesn't make sense from a social and ethical point of view.

by Michael Wolraich on Fri, 12/02/2011 - 2:55pm

There's no ethics to it - you haven't made an ethical argument about why it's a problem that has to be corrected.

The media takes left & right views so it can say "both sides do it" even if one has a pop gun and the other a nuclear device.

Some people work harder, more clever, luckier, use nepotism, use illegal methods, are discriminated against, are incredibly good looking, rouse their fellow workers, abuse others, work for larger companies, inherit the business, created their own position, live in a high cost city...

It's curious - the imbalance has been between inherited & investment wealth vs. earned income. And you want to place an arbitrary cap on high earners that further favors business (don't think they wouldn't love to keep down exec pay - unless it's themself personally). More money for the investors! Hurrah!

by Anonymous (not verified) on Fri, 12/02/2011 - 3:08pm

You are incorrect on the earned income not being a big part of the inequality problem. See Yglesias' citation in my reply to Genghis below (he links to the Pikerty/Saez paper on U.S. inequality.) Or you can just look at Genghis' chart and figure out just by the years involved that the problem is not inherited wealth but nouveau riche. Nouveau, as in new, as in earned just recently, as in the last few decades. Paris Hilton has got a lot of dough but there aren't enough of her kind to let everyone else off the hook.

The evil investors/capitalists these days are often as not a worker's pension fund, or that mutual fund you picked for your IRA or Keogh.

by artappraiser on Fri, 12/02/2011 - 4:38pm

Somehow, I don't see this as being very popular for investors in companies with high salaries for top employees. They will have to pay more taxes. It's not an excuse, it's a disincentive.

As for the ethical question, the whole point is move away from the question of individual ethics. If you don't commit abuses, there is nothing unethical about earning money. But cumulatively, you could end up in a society without a middle class in which the rich own nearly everything. In my mind, that's a bad thing even if no one committed ethical abuses on the way there. That's why I'm proposing an incentive system to keep us from ending up there.

Think about anti-trust law. There is no inherent ethical problem with corporate mergers, and mergers often makes good business sense. But a society dominated by monopolies will have a lot problems, so you regulate to keep it from happening.

by Michael Wolraich on Fri, 12/02/2011 - 4:36pm

Well, ok but if that's what you're thinking about, you're kinda of hiding something which tends to be more controversial with this phrase:

and other highly paid professionals

like pro basketball players, popular movie stars, and writers of Harry Potter stories, etc.

It's easy for many to agree those boring white collar guys shouldn't be paid so much, but I do often see the argument that one's favorite basketball player should be entitled get all he can out of those greedy owners.

As Yglesias pointed out in a piece yesterday, we got a problem in that "worker" does not mean what it used to, and it's other "workers," not rentiers (old fashioned capitalists,) that are making for income equality:

As for celeb types who earn on their popularity, if they see that they will earn less on "wages," they do the CEO/tax attorney thing if threatened too, they just become more capitalist rather than "worker," taking a cut of the business/movie instead of a salary or creating their own business in selling their name on products (I always wanted to see the demographics of who is buying all those George Foreman grills.)

by artappraiser on Fri, 12/02/2011 - 4:27pm

I fail to the see the substantive difference between an i-banker who makes millions and a basketball player who makes millions. The objective is not to keep people from capitalizing on their skills but to curb the gross inequalities.

by Michael Wolraich on Fri, 12/02/2011 - 4:42pm

A ha! Overpaid attorneys, now we're beginning to understand the problem.

by Oxy Mora on Fri, 12/02/2011 - 8:11pm

I question a chart on salary composition that ends in 2000, at the height of the internet boom.

This article below notes the great increase in corporate income in the last couple years that wouldn't be paid out in salaries:

http://thinkprogress.org/economy/2011/06/30/258388/corporate-profits-recovery/

Another unmentioned aspect here is how government can help increase value of workers to corporation. Universal health care is one I always supported - takes the HR department out of the health shopping business, and takes health calculations out of the P&L columns for some beancounter to gamble with.

Another is productivity. Certainly workers with assured health care and a decent reporting system waste less time on phone menus and more time on work.

Our education system can take into account what type of work shifts are going on here. If Project Management is becoming an essential aspect of most high paid work, the principles of project management, team building, continuous improvement, etc. should be part of a much earlier training. If a local workforce can hit growth targets where an offshored one can't, voila - greater value noted in $.

There's a good deal that can be done to give work local value that can't be replicated generically or overseas.

There are areas of high tech creativity that we still do rather well. There's social ingenuity combined with VC attitude that lets Americans create a Facebook or Amazon or Google much easier than other countries.

I like all ideas of trying to add value into the system and its structure, or I like fairly obvious taxation and wealth distribution schemes that hit a basic societal need.

Paying for base services is a societal need. Preventing or lowering unearned wealth between generations has a societal justification. Hitting some perceived % of pay equality is just fickle opinion - there is no obvious quantitative principle to base it on - it's just wet-finger-in-the-air social tinkering, with no real metric to say when you've succeeded nor any decent appreciation of the side effects.

by PeraclesPlease (not verified) on Sat, 12/03/2011 - 3:23am

As I understand the consequences of the explosion of "financialization" AA is referring to, there is a direct connection between the insider quality of deals of the kind demonstrated by CEOs colluding with executive boards and a particular player lower down in the system getting a 500K cut of the profit made by directing some super-valuated shares to flow to their companies coffers.

I have been thinking about the idea of changing the tax structure for corporations for some time and the establishment of a clear threshold of the kind you speak of always gets me entangled in the question of whether or not the trades made at the highest level are all "insider" deals. Having a highly competitive environment is no guarantee that the game isn't rigged on many levels. How do we counter the incentive to be further "inside"?

by moat on Fri, 12/02/2011 - 8:18pm

I think it's an impressive and novel idea. Definitely haven't seen it before. My worries would be:

1) It would drive down wages for all workers, not just workers at the top. Indeed, really big companies could argue that they can save more by cutting the salaries of 10,000 workers in the middle than by cutting salaries at the top.

2) Clinton tried to discourage companies from overpaying at the top by capping the corporate tax deductibility of those salaries at, I believe, $1 million. The result? Base pay and benefits shrank and were replaced by warrants, stock options and other equity incentives. These turned out to be worth far more than the old cash compensation and it's one of the reasons, besides the Clinton boom, that the ultrawealthy became uber-wealthy. Your plan could encourage more equity based compensation, which has its benefits and problems.

3) Companies would respond to this by... not having employees. We'd move to a contractor economy, something that both of us are familiar with as we have worked freelance. You can regulate against that, of course. The IRS already says that if you can tell a person where and when to work that they are, in effect, an employee. A contractor has certain rights and one of them is to do the contracted work roughly on their own schedules. But I could see many industries responding to this by saying, "guess what, you're all fired but we'll contract your jobs back to you. You don't have to follow the employee handbook anymore, but at least you're still a business expense and not a liability."

by Michael Maiello on Fri, 12/02/2011 - 1:53pm

Thanks. I did a little research to see if I could find a similar proposal out there. The closest I found were some suggestions to make FICA progressive.

1) You can make the minimum threshold whatever you need to in order to protect workers. $50K? $80K? To minimize pushback, you would probably want to phase it in in such a way that existing salaries are not cut but that raises and new hires are affected.

2) You would need to calculate in equity. Just as individuals have to pay income tax on stock grants or discounted stock options, companies would be taxed for such grants.

3) Interesting point. I hadn't thought about it. I would think that you could apply the same law to private contractors but not to corporate entities. But the corporate entity, call it Genghis Industries LLC, would be subject to the tax itself if the contractor took a payment. I guess the problem would come if GI paid me in dividends rather wages. I'll have to think about it.

by Michael Wolraich on Fri, 12/02/2011 - 2:23pm

On point 2, you do pay taxes on stock options, but not when they're issued, only when they're exercised. Then you pay capital gains, which is a low 15% rate. Of course, you have a lost cost basis because you worked at Facebook from year one and were given shares at an exercise price of $3. But, you're not taxed when you get the options.

It'll be hard to tax companies for issuing stock as wages. The company would have to pay a tax for every share it issues, at the time of issuance. Heck, maybe I'm wrong. If you did that, it would discourage issuing stock to employees. But, again, that has its own set of problems.

The alternative is you wait until employees exercise their options, calculate their gains, go back to the company and say "we're factoring that into your compensation tax." But that would really discourage stock issuance because a company wouldn't even know its liabilities.

by Michael Maiello on Fri, 12/02/2011 - 2:59pm

It was as you describe in the early years of the dotcom boom when stock options first became popular, but that changed years ago. If you're issued a stock option for free or at below value, you have to pay income tax on the differential. The change screwed a lot of workers during the bust who ended up owing taxes on stock option grants that turned out to be more than the eventual sale price of the devalued stock.

by Michael Wolraich on Fri, 12/02/2011 - 3:58pm

Ah, makes sense. Which is likely why a lot of companies now issue options at the prevailing market price at the time of issuance.

by Michael Maiello on Fri, 12/02/2011 - 4:10pm

Yeah. There's a gray area for private companies, but if you receive stock options for a lower price than the value of the last issue of stock to investors, you'll have trouble with the IRS.

by Michael Wolraich on Fri, 12/02/2011 - 4:23pm

I work in the entertainment industry, and I've seen point 3 become more and more common every year, with very little enforcement of the laws defining when a company can legally classify someone as a contractor.

Two thoughts regarding your tax proposal. The first is that it reminds me of "luxury tax" rules in pro sports. I'm not an expert in that area, but it might be a good model for seeing how this policy might work in practice.

But the main addition that I think would complement your idea and make it more effective would be for this new corporate tax to be triggered by the ratio of the highest paid workers' compensation versus the lowest. Then there would not only be downward pressure on the top but also an incentive to raise the wages of the workers on the bottom. This would have to take into account overseas employees too, otherwise a company could improve their ratio by outsourcing.

by The_Real_DDA on Fri, 12/02/2011 - 3:51pm

Thanks, DDA. I had actually thought about your suggestion originally, but it doesn't work very well for law firms, hedge funds and such where the majority of the employees are highly paid. I also worry that companies would spin off subsidiaries that officially employ exclusively highly-paid executives in order to avoid taxes on the wage differential.

by Michael Wolraich on Fri, 12/02/2011 - 4:03pm

Ah, good points. In those cases, I would propose a second trigger based on the ratio between the organization's average compensation versus the average of all American workers.

This is the kind of brainstorming on taxes that I wish we saw more of from the Democrats. Instead, they just limit themselves to the false dilemma of whether or not the Bush tax cuts should be extended.

by The_Real_DDA on Fri, 12/02/2011 - 4:31pm

That could work. But the first trigger has to limited enough or the second trigger costly enough to deter executive spin-offs. It's well beyond my economic expertise to calculate.

by Michael Wolraich on Fri, 12/02/2011 - 4:55pm

I don't particularly care if someone earns 10000x what I earn as long as I 1) have enough to survive, and 2) have reasonable opportunity to earn more if I want, and of course 3) the country runs in reasonable fiscal shape, and 4) progressive social programs & safety nets are in place.

Why exactly 1970's levels of taxation & income disparity are golden? The Reagan cuts seemed fine - forgetting S&L giveaways as a precursor to TARP. Clinton tax increases seemed to find the sweet spot - apparently there *WAS* a left side to the Laffer Curve.

"Overcompensated employees" is a red herring. The 24th best paid CEO earned (?) $30 million while bringing in investors a 15% return. We don't quite know whether he's responsible for that return. But we do know that his pay is relatively irrelevant - in the unlikely chance he can work 15 more years at that rate, that half billion dollars is paltry compared to Mark Zuckerberg's wealth.

And Mark Zuckerberg makes $1 a year. $17.5 billion in the bank. So cut off his high salary and he'll go crying, right? Only 20% of family income over $10 million comes from salary. Meanwhile, why should a company be penalized for paying a high performer well, and why should that high performer bring the same penalties as someone who gets a golden parachute for failure?

America's wealth is owned by investors and inheritors, not the "overpaid" CEOs or other workers. Yeah, Wall Street salaries are likely inflated. As are Hollywood's or Baseball's - once you've made it. But they still don't rise to a real problem.

The real problem is that people with serious wealth no longer pay taxes. 2010 individual tax receipts were back partying at 1999 levels (hey Prince!), while 2009 corporate was at 1994 levels. And of course we had war expenses and a much larger population than we had under Clinton.

Even the focus on the top 1% - $340K+ - is misleading. It's basically the top 0.1-0.3%, but that doesn't make a good placard. "we are the 99.7%" But it's important to realize that it's easy to find a false target in this environment, since the right targets have done such a good job at shielding their wealth all these years.

by PeraclesPlease (not verified) on Fri, 12/02/2011 - 2:32pm

http://www2.ucsc.edu/whorulesamerica/power/investment_manager.html

by PeraclesPlease (not verified) on Fri, 12/02/2011 - 2:35pm

Maybe the problem is that you see it as a penalty. Instead one can look at it as giving back to the nation that made it possible for the high performer to perform well. The top sales executive still needs to highways and airports and so on to go smooze the big clients. He or she needs the infrastructure and law enforcement agencies to keep people safe and so on. So if the company is in position because of profits to pay their executives an extra 5 million, maybe they can throw 500,000 of back to the community, and compensate them with 4.5 million.

by Elusive Trope on Fri, 12/02/2011 - 3:15pm

So if I spend $5 million on a piece of equipment, no charge. If I give $5 million more to investors, no charge. If I spend $5 million on a productive worker, I get to pay a penalty, but euphemise it as "giving back to the system".

Presumably that worker would pay 30%+ marginal tax on that $5 million, but you want an extra 10% because you've decided that those earning between $5million & $100 million are immoral, but those making investment income of $20 million to $3 billion get to keep their low 15% capital gains rates.

Something ain't clicking.

by PeraclesPlease (not verified) on Fri, 12/02/2011 - 3:49pm

I wouldn't posit that this one approach is the only thing needing fixed, or that it would be the cure all. Capital gains tax is something that needs to be addressed as well.

Spending money on a piece of equipment shouldn't be taxed because (1) it is increasing the productivity of the company and (2) it is a consumer purchase so to say and helps bolster the economy.

I don't think it is a question of it being immoral to pay people that much. What I do have a problem with is a company letting go of employees or closing this or plant, which increases short-term profit, and the executives getting their increases because of that. It has nothing to do with productivity of a super motivated employee. I also have a problem with a company that spreads the wealth at the top and not throughout the entire organization. By increasing the employee wages, then profits go down, which is why they don't do it.

Actually what would be more aligned with my thinking, but immensely too complex to implement, would be an exemption of this kind of payroll tax as long as there was a reasonable percentage between the highest paid employees and the lowest paid ones (and maintaing of employee numbers). As long as the grunts were rising along with the top ones, then all is well.

by Elusive Trope on Fri, 12/02/2011 - 4:12pm

Very good points, Peracles. Productivity, aided by high cap ex spending, is particularly high now, which increases profits and lowers overall wages. Wages as a percent of corporate income are at historic lows. Profits are at historic highs. So spending on "equipment" is helping the overall economy but not helping the folks doing the work. As you say, passive investors win, through dividends and price appreciation of the stock. CEO's, because the borrowing costs are almost nothing, can borrow money at low rates, use the money for stock buy-backs which increases share prices and in effect, is an implied dividend to share holders. Under any tax plan, CEO gross pay would increase and they would be making more money than before the stock buy back. Also CEO's have a neat trick where where they borrow money against a forward contract to sell their stock in a certain price range. This in effect gives them personal low interest money to play with as passive investors in the market, or whatever.

I should add that most of the above takes place in large, publicly listed companies. Executives in small companies by and large don't make enormous salaries. One of the overall reasons wealth distribution is screwed up is that large corportations, including large financial corporations, have a great many advantages and breaks that small companies simply don't have or are too small to take advantage of. And of course I mean small "make and sell" companies, not small financial firms who make money with money and pay a 15% tax rate.

by Oxy Mora on Fri, 12/02/2011 - 9:13pm

I called it a penalty, though a more appropriate word might have been disincentive. The government uses incentives and disincentives to establish socially beneficial practices in many ways. I see little difference between a tax abatement to encourage charity, environmentally sound practices, etc. and tax increases to discourage practices that lead to an unjust society.

by Michael Wolraich on Fri, 12/02/2011 - 4:11pm

I'll just jump in here on the overall approach you suggest.

First, I think this kind of discussion is great. It's forward thinking in a positive way. As you suggest, to get a new product you have to do the brainstorming. I applaud you for initiating it. I wish we could do more of it in this context.

I have an overall philosophical question. Are we entertaining a new and creative solution because we have lost the moral authority to advocate for a progressive personal income tax rate?

I liked Peter's drift, shouldn't we back up and identify all the wrong things which were done to shift the balance of wealth and begin a long term progressive plan to reverse it. So much of the problem has been directly related to bank practices, regulations and the lore of masters of the universe and other forms of social justification for excesses. There are some significant opportunities to reign in the banks, as well as the justifications used to bloat them, and I think progressives should spend a great deal of time on that.

by Oxy Mora on Fri, 12/02/2011 - 9:33pm

Alternate Minimum Tax was one effort to fix this issue.

Secondly, part of the problem is that big businesses aren't paying much in tax, and so we're concerned about getting more out of them - but this one likely changes little. If my company is doing $20 billion in sales a year, whether I pay a CEO $10 mill or $40 mill is only 0.3%

Third, cutting off the top won't help the bottom. A simple way to fix this would be to tax high individual & corporate profits higher and create a better safety net & tax benefit that helps out the ones on the bottom. This can mean lower mortgage rates for low income workers, better health benefits to prevent out-of-pocket expense, better facilities available for everyone rather than say libraries gasping for air.

Of course that's a dream - we've got Norquist ruling America, convincing even Obama that cutting trillions from the budget is needed.

by PeraclesPlease (not verified) on Sat, 12/03/2011 - 3:07am

I took for granted that economic inequality is a social ill. I think that the question of what makes it a social ill is an interesting question for which I don't have an easy answer. At first blush, it's not the actual wealth differential that bothers me so much as the excessive consumption of the rich. I also believe that the decline of the middle class has serious consequences for political ideals of the nation.

The relationship between wealth and power is a separate question, but it's also one that I think too many people take for granted. The question is how does wealth translate into power, and how can we control it other than (or in addition to) reducing the relative wealth the top echelons.

by Michael Wolraich on Fri, 12/02/2011 - 3:51pm

One issue is that when the wealthy have a tremendous amount more buying power than everyone else, they cause inflation for things like homes, education, medical care and even access to cultural institutions and artwork. There are some things in short enough supply that an uber wealthy class can actually affect that.

by Michael Maiello on Fri, 12/02/2011 - 4:16pm

I think I'm more concerned when 'monied interests' are able to 'buy' elections, particularly locally - essentially, use the power their money provides to do things like this:

http://motherjones.com/mojo/2011/08/koch-brothers-school-segregation-americans-prosperity

When 'money' can change the way someone lives, the way a community works, based on their selfish interests/morals/standards/whims, that's when the 'little guy' tends to get screwed and America starts taking six steps backwards for every half step forward.

by Jeni Decker on Fri, 12/02/2011 - 4:45pm

As long as there is great disparity in wealth, there will be great disparity in political power. There is no way to erect a wall of non-intervention between wealth and politics. The more you have, the more you can buy. And among the things that will always be for sale are the means of governance.

by Dan Kervick on Fri, 12/02/2011 - 4:55pm

Which is why I think campaign reform is absolutely necessary. For my money, I don't think PAC's should be legal at all. Period. There should be a dollar limit, a reasonable one - and reasonable doesn't mean hundreds of thousands of dollars, or even tens of thousands of dollars - put on campaign contributions per person. And there shouldn't be loopholes that allow, let's say, Richie Rich to donate himself, then give his five year old grandson fifty thousand dollars to donate as well.

I think there's absolutely a way to 'erect a wall of non-intervention' between wealth and politics' and that's to say, No, you're not allowed to funnel money into campaigns to get the outcome you want, simply because you're rich. To me, this is the very heart of the problem with this country and politics. Because the people that 'buy' a public policy maker are ensuring that policy maker will make the choices that they want, and those are almost never choices that benefit the vast majority of the American people.

Now, clearly even though there are solutions to this problem, doesn't mean there's a snowball's chance in hell of it ever happening.

by Jeni Decker on Fri, 12/02/2011 - 5:16pm

True--which is abundantly clear to us New Yorkers. Sometimes I wish that every owner of pied-a-terre in the city were forced to sell.

by Michael Wolraich on Fri, 12/02/2011 - 4:45pm

I like the idea at first glance. It says to a company - if you are able to pay your executives more, then that must be because the company is doing better profit-wise. If all companies have to participate, then a progressive payroll tax on the executives would not interfere with competitiveness (e.g. losing quality management team to their competitor who can compensate them more).

A side note to this. What is missing in most discussions on this topic of income inequality is how is directly related to a bad economy. Just looking at the graph - during the Clinton boom years, the inequality was pretty dang bad, yet people were prospering (on a bubble). Usually one is pointed to the inequality that existed just before the Depression. But in simple terms how this inequality related to the crash, or to this downturn is not provided.

In other words, if the economy is humming along and people are basically able to meet their needs and a little more, what does it matter that the 10% have 80% of the wealth. Maybe 20% of the overall wealth pool from which to dip into is enough to keep the 90% of the people basically content with their economic situation.

by Elusive Trope on Fri, 12/02/2011 - 2:33pm

People have been concerned about income inequality since the 80s, but more people are concerned about it now--because it's gotten worse and because the hardship of the recession makes the inequality seem more egregious.

Dank K also has a theory about the role of income inequality in causing the economic crisis by reducing the spending power and increasing the debt of the middle class.

by Michael Wolraich on Fri, 12/02/2011 - 2:45pm

If we reduce the incomes of those below, then this will impact the consumer economy. As those incomes go down, and the executives make more the inequality will increase. But was it the inequality what cause those lower tier incomes to go down in the first place? Or is inequality of incomes just a symptom of other forces? Is the inequality just a canary in the coal mine, but not related to the creation of the toxic air that are endangering the miners?

by Elusive Trope on Fri, 12/02/2011 - 3:02pm

See Bloomberg Nov. 30 op-ed by self-identifed very rich person, Nick Hanauer,

Raise Taxes on Rich to Reward True Job Creators

(He explains that he thinks the true job creators are regular people shoppers, and not the uber-wealthy shoppers, as the latter can only own so many I-phones, face creams and toasters. He uses "shoppers" instead of "consumers," and he means all the people in the classes below him.)

As I see it, there is no what-came-first-chicken-or-egg problem here, Trope. The loss of feelings of being "well-off" among the other less-than uber-wealthy classes - whether illusionary real estate wealth, credit wealth, IRA wealth or feelings of wealth due to a good secure steady job, or similar - made them tighten their pocketbooks which caused more layoffs after the shock of the banking crisis, which caused less buying, which caused more layoffs, etc.. Individual businesses are holding cash still now because they think there are still too few shoppers to buy more stuff; many small businesses know every day there are fewer shoppers and struggle not to let workers go.

People derided the "go shopping" thing after 9/11, but it is true that one of the things intended by the hit was to stop the western economies in their tracks by making people stop spending on travel and everything else. There's really no cogent argument that we are not a consumer economy. One can certainly argue that it's bad, but not that it is not our situation since post WWII. Economic growth was the masses buying more stuff, to the point of that thing called "planned obsolescence."

I remember I was kind of driven a little nuts by several people on TPMCafe (around 2009, probably) discussing what purchases they were going to "give up" in solidarity with the unemployed. Like it was Lent and they were Catholic, and somehow giving up some of one's usual spending would help -and curtailing usual spending was what they were talking about--i.e., give up coffee, candy or cologne, eat less expensive food, patch clothes instead of buying new, drop cable TV, cut your own hair, etc. I said: only if you give the money you saved directly to an unemployed person to spend will it help them, otherwise you're assisting in laying more off. One response was I was being "materialistic," that I should think about making do with less like the unemployed were. Way to go to help further crash an economy!

by artappraiser on Fri, 12/02/2011 - 9:12pm

Intriguing.

Only read once quickly, but at the top you seemed to say you weren't going to equalize through taxation. Then, it seems, you try to equalize through taxation.

Why not list all the factors that led to greater equality in the 50s and 60s and 70s and see which ones we can replicate now?

More later...

by Peter Schwartz on Fri, 12/02/2011 - 3:23pm

The difference is a little subtle. Income tax reduces inequality through redistribution, which I find problematic. My proposed tax is designed to reduce inequality primarily through incentives.

by Michael Wolraich on Fri, 12/02/2011 - 4:06pm

The real trouble with income tax as a solution to economic inequality is that it addresses the symptom, not the disease

This all goes to the definition of 'earnings'.

That CEO of a public corporation supposedly owned by shareholders--shareholders whose rights have been severely curtailed by legislation--ends up with hand picked board members who are bribed to give him remuneration far in excess of his contribution to the corporation or society.

Tax increases would help so that a company with a 6 billion dollar deficit and 6 billion in corporate management bonuses would feel the further pain of a tax penalty for such felonious activity and really piss off the shareholders!

And if those bonuses were taxed at a rate of 75%, the shareholders would see that the government is receiving 3/4 of their monies.

Why not put a payroll surtax on those making over a mill in one year so that 25% would be due for Social Security taxes?

And while I am at it, what about a VAT on all bonuses in the form of stock shares or stock options?

Frankly I think it is time for a VAT right now across the board; for every share sold.

Getting back to corporations; a corporate charter is granted by the states and the Federal Government under certain circumstances.

Forget this Delaware model for a second. If you wish to do biz in a state or territory of the USA, you must follow certain rules.

An attorney must keep track of her hours in order to receive requested attorney fees under many conditions.

The same goes for accountants and doctors and a number of professions.

Why should CEO's not be held to the same responsibility?

So you limit the amount per hour management can charge for their time!

Where will we lose business in this new model? In Europe? hell!

In China? Bullshite. As I understand it corps doing biz in China end up with China being its partner like in the old East India paradigm.

Today Wisconsin is threatened with abandonment by businesses (according to that moronic fascist Walker) if the state does not accede to their demands. "I will take my biz to Alabama or Texas if you give unions rights."

The Federal Government could move in and take away a lot of the incentives that permit biz from making states compete by sucking corporate....oh yeah.

The governor of Texas says:

Hey, move here and we can get people on your manufacturing line for minimum wage or close to it and we don't allow no union pricks down this away. ha!

And if administrative courts were set up to allow shareholders the right to submit their grievances we would have another equalizing factor put in place. In the old days five or ten shareholders could get together and bring a class action against the corporate pricks who steal from their companies.

The Feds, right now, could hire a hundred thousand attorneys--remember when Clinton hired 100,000 cops?--to simply investigate corporate crimes! ha

These arseholes making two, ten, 100 mill a year are stealing. That is a fact.

Just show me the checks and I can assume felonious conduct.

What was the question again?

by Richard Day on Fri, 12/02/2011 - 3:38pm

:) The thing is that most people don't regard earning gobs of money as nefarious, let alone felonious. And I think they have a point. There are few among us who would refuse to take a raise or bonus just because we already have too much money.

That is not to condone criminal or fraudulent behavior, however. There is a difference between a Goldman banker who makes millions off of deliberately overvaluing derivatives and one who makes millions off a run-of-the-mill bank merger.

by Michael Wolraich on Fri, 12/02/2011 - 4:18pm

by Richard Day on Fri, 12/02/2011 - 4:44pm

We don't really want to fill the ranks of CEOs, bankers, and lawyers with clock-punching dead weight.

I don't see why that would happen, Genghis. Forcing a company to cap the salaries of their top earners only puts them at a competitive disadvantage if they have to compete with other companies who are not doing that. If we just impose some kind of maximum wages or salary caps, what are the poor CEOs going to do - run away to India or China to make more money? Please. And for the few who do ... good riddance. Despite the hagiographies in the business mags, these cats aren't geniuses. Every one of them can be replaced.

The CEO-to-bottom employee pay ratio in the US is something like 147 to 1. In Sweden its 12 to 1; in Japan its 11 to 1. What do we know that those countries don't? Nothing. We are just much more tolerant of antisocial greed, class warfare and racketeering in this country.

We can just impose a 20-to-1 rule, and other restrictions on stock options, bonuses etc. and be done with it. Top earners can still increase their salaries if they can figure out how to raise the salaries of everyone else in their companies. But an alternative approach might be to set up a whole host of egalitarian compensation guidelines like that, and then designate companies that are certified as following the guidelines "American Patriotic Teamwork" companies, or something along those lines. The guidelines could be officially "voluntary" - but there could also be a large variety of tax, regulatory or insurance incentives set aside for companies that follow the guidelines.

That would probably do the job with most boards of directors. I daresay there would be a whole host of hard-working, smart and non-greedy people who who would be proud to put their talents to work in such companies. We could take care of some of the others via shaming, and the threat of further legislation. After most parts of the corporate community got on board , they would constitute a lobby that would put increasing pressure on the outliers.

by Dan Kervick on Fri, 12/02/2011 - 4:35pm

With regard to 20-to-1, see my comment to Real DDA above. First, it would address only top executives in large companies, not i-bankers and lawyers who would just pay their office managers more. Second, companies would just spin off executive subsidiaries to manage the workers.

But more to the point, the issue is not (only) that executives would rush off to India; it's the lack of bonus structure. If your only concern is not to be fired, why make an effort to improve the company, sell more products, win more cases, etc. I believe that rewarding talent improves performance and productivity. That's why I want to make it more costly to reward talent relative to the less talented, not illegal.

by Michael Wolraich on Fri, 12/02/2011 - 4:52pm

I don't see why the guy who makes $200,000 per year, but has the opportunity to boost it to $300,000 through incentive payments has any less less motivation than the guy who earns $50,000 and can boost it to $75,000 with incentives. Boards should pay CEOs some low six figure amount, and never pay them the allowed cap if they want to make them work harder.

Anyway, 90% of people in America find all the incentive they need to do their jobs fairly well with much more modest financial incentives dangled in front of them. A large number of Americans have hardly any possibility of very significant income growth. They do their jobs well, work well with colleagues, pull down a paycheck, and maybe get a little raise every year. If they are afforded any incentive pay at all it is for a few thousand dollars. And maybe they can aim at a promotion. If they fail to perform they get fired. CEOs can join the club.

But if someone who has reached the top is too bored to work because he is lacking - like a Hollywood prima donna - sufficient "motivation", then fire him and bring in some new blood. There are always younger or less sated people willing to move up and take on a more challenging job.

Most people don't need significant financial incentives to take on the more talent-intensive jobs, or jobs with more responsibility and power. Those talent-intensive jobs are generally way more interesting that the more humdrum jobs. And a large number of people crave being in charge. Even if the head of General Electric made only $200,000 dollars, there would be no end of smart and ambitious people who want to do the job - because it's pretty f-ing cool to be the head of General Electric.

by Dan Kervick on Fri, 12/02/2011 - 5:11pm

It's not about 200-300k vs 50-70k. That's my proposal, more or less. Reduce the salaries (or at least reduce the salary growth) through tax disincentives.

But you're talking about a cap. With a cap, the top executives will demand the maximum wage, and they will get it, just as they get such tremendous salaries today. The maximum wage leaves them no way up--no bonus, no raise, no nothing.

Now you can wax on idealistically about how people don't need monetary incentives, but I can't imagine you really believe that monetary incentives don't improve performance. Companies don't offer their employees raises, bonuses, stock incentives, and so on because they enjoy lavishing cash on them.

by Michael Wolraich on Fri, 12/02/2011 - 7:36pm

The maximum wage leaves them no way up--no bonus, no raise, no nothing.

So what are they going to do? Quit? Fine. There are a lot more fish in that sea. One incentive for working hard is that, if you don't, someone else will take your job away from you. That's how most Americans live today. There aren't a lot of raises being handed out in contemporary America. But there are plenty of pink slips. I'm sure those poor CEOs and traders can find it in themselves to keep their noses to the grindstone if the choice is between a stagnant $200K salary or being marched to the pavement with the contents of their desk in a box.

But anyway, the 20-to-1 version of a wage cap does give people the opportunity to improve their economic lot in life. They just have to work with everyone else to do it together.

The same would be true with a national wage ratio cap - which would take care of the business of the investment bankers and lawyers. People can still get richer. They just have to do it together. If the top earners want to increase their income, they will have to get busy lobbying the government to invest in making the country more productive, and in raising the wages of the bottom earners. If they can make the wages of the bottom workers go up by $5000 in some five year period, they can raise their own incomes by $100,000 in the same period.

I believe we would be growing stronger and faster right now if we were continually re-investing the surplus produced by the very productive American workforce back into public and private enterprises, rather than siphoning off great gobs of it to pay the wasteful salaries of the most fortunate.

by Dan Kervick on Fri, 12/02/2011 - 8:29pm

An income cap puts a cap on achievement.

by Richard the Ele... on Fri, 12/02/2011 - 8:35pm

No. Many successful people work for reasons other than money. Some even admit they would pay others to be able to do their jobs.

For example I'm designing a restaurant, and brought it home this evening, and am having much more fun than usual.

by Donal on Fri, 12/02/2011 - 8:50pm

Well, let me know if your restaurant needs a master electrician. I do travel, and I can make anything work.

by Richard the Ele... on Fri, 12/02/2011 - 9:13pm

Turn the system upside-down. In addition to raising the minimum wage, lower the maximum wage. Make the salaries for jobs be based on physical effort, rather than higher position (or higher brain function.) In other words, pay fry cooks and corporate mail-room trainees millions of dollars a year and CEOs the minimum wage. People would earn the most when they start out as go-fers and increasingly less as they become more successful. And you ensure they can't stay too long at the bottom by making it mandatory that bottom entry levels jobs can only be held onto for 2 years. Make the real status in society become how little you make, not how much. The incentive to work hard and become successful then becomes more about earning prestige and power than about money. Doing this allows the most money to be in the hands of the very young, who, as we all know, are the biggest, most eager consumers, thus stimulating the economy. But it also demands that people become more aware of personal financial planning, knowing that they will be earning less and less in the future, they need to make sure they plan ahead, save and learn to invest their money wisely.

Conservatives already hit Progressives with phony charges like: "They want to take all the money from the rich" and 'They believe in Socialist Economic Re-distribution', so, let's go all the way and really give them something to scream about. ;-)

by MrSmith1 on Sat, 12/03/2011 - 2:57am