MURDER, POLITICS, AND THE END OF THE JAZZ AGE

by Michael Wolraich

Quantitative Easing, we hardly knew ye, and now ye are gone without a lot of people even knowing what ye did or how ye did it. Well, here were some of your effects. But I think you will have more of a legacy than that. To Ben Bernanke, QE was a theoretical idea that he had no choice but to put into practice after the Financial Crisis. The Federal Reserve had dropped the overnight lending rate to zero and yet the economy responded only sluggishly. At this point, remember, it was considered dangerous for the Fed to drop rates so low because the bank would expose itself in a gunfight as the cowboy with an empty revolver. You can’t go less than zero, after all.

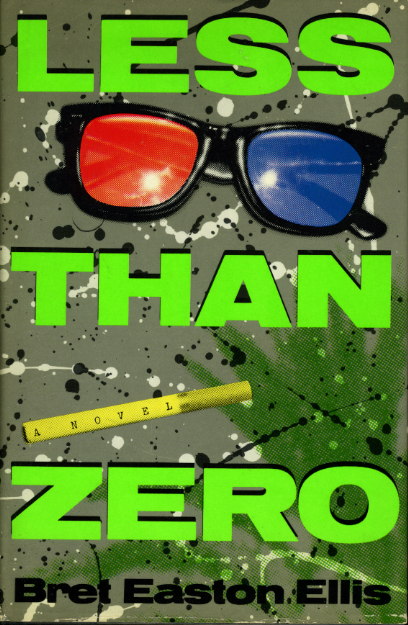

Well, Ben Bernanke must have read his Brett Easton Ellis.

While the Fed had indeed reached the lower bound of the overnight lending rate, Bernanke’s creative thinking gave the bank options. First, he could pay interest on bank deposits at the Federal Reserve. This gave banks a risk free way to make money by doing nothing.

Like I said, Bernanke apparently read his Brett Easton Ellis.

The other move was QE. As part of the program the Fed bought Treasury Bonds and Mortgage Backed Securities in the open market. This helped to keep consumer, mortgages and business loan interest rates low. An important distinction is that when the Fed “drops rates” it is really only dropping the rate at which the Fed lends to banks overnight. Existing debts, traded as loans and bonds in the market, have their rates set there, not by the banks. So, even if the Fed drops its rates very low, market rates for bonds can be very high. Bond rates rise when prices fall. Bond rates fall when prices rise. By stepping into the market as a large buyer, the Fed helped to create price support for Treasury Bonds (the benchmark for all other bonds) and for mortgage rates. This further helped the banks, by the way, because they could get free money from the Fed and use it to buy interest paying Treasury bonds, which they did, further driving down the price of Treasury bonds and helping the Fed keep interest rates low.

The other move was QE. As part of the program the Fed bought Treasury Bonds and Mortgage Backed Securities in the open market. This helped to keep consumer, mortgages and business loan interest rates low. An important distinction is that when the Fed “drops rates” it is really only dropping the rate at which the Fed lends to banks overnight. Existing debts, traded as loans and bonds in the market, have their rates set there, not by the banks. So, even if the Fed drops its rates very low, market rates for bonds can be very high. Bond rates rise when prices fall. Bond rates fall when prices rise. By stepping into the market as a large buyer, the Fed helped to create price support for Treasury Bonds (the benchmark for all other bonds) and for mortgage rates. This further helped the banks, by the way, because they could get free money from the Fed and use it to buy interest paying Treasury bonds, which they did, further driving down the price of Treasury bonds and helping the Fed keep interest rates low.

Brilliant stuff. The recovery was not all it could have been, though, because monetary policy can only accomplish so much. The government needs to help with the right fiscal policy which, in this case, would have included a much larger stimulus.

We have to work together, which Bernanke knows from reading his Brett Easton Ellis.

Still, we have learned a few things. The first, I am happy to inform you, is that the Fed’s creative bond buying program did not cause hyper-inflation as its critics feared it would Bernanke has coolly informed the gold bugs of this.

Second, we now know that central banks are not limited by the zero bound on interest rates. Even as the Fed contemplated tapering its QE program (it began shrinking it in December 2013) the Bank of Japan embarked on its own, in concert with Japan’s government. This means that Bernanke’s once novel idea is now an acceptable tactic for any central bank to use when faced with a deflation or depression scenario. A central bank, it turns out, can do a lot after rates reach zero. The once boring job of central banker is now…

As Bret Easton Ellis might say…

Comments

In his own words in an interview. He seems to be a complex person.

by trkingmomoe on Thu, 10/30/2014 - 12:55am

But a good novelist, back in the day!

by Michael Maiello on Thu, 10/30/2014 - 6:14am

Just a fancy term for federal open market activity. Plus, it benfitted one tier - the top. Giving insty's a zero for risk - enough jazz to get them up and excited about charging the public 20%.

Gross

by Akhenatron (not verified) on Sat, 11/15/2014 - 7:32pm